| Deposit currency and minimum amount |

Armenian drams, minimum amount AMD 100,000 US dollars and euros, minimum amount USD/EUR 500 |

|---|---|

| Deposit term |

AMD - Minimum: 3 years Maximum: 10 years USD/EUR - Minimum: 3 years Maximum: 5 years |

| Interest rate |

The interest rate for the cumulative Term deposit is equal to the sum/difference of the Bank’s retail base rate and the Bank’s constant margin.

|

| Deposit currency and minimum amount |

Deposit term |

|---|---|

Armenian drams, minimum amount AMD 100,000 US dollars and euros, minimum amount USD/EUR 500 |

AMD - Minimum: 3 years Maximum: 10 years USD/EUR - Minimum: 3 years Maximum: 5 years |

| Deposit currency and minimum amount |

Interest rate |

Armenian drams, minimum amount AMD 100,000 US dollars and euros, minimum amount USD/EUR 500 |

The interest rate for the cumulative Term deposit is equal to the sum/difference of the Bank’s retail base rate and the Bank’s constant margin.

|

1Cumulative Term Deposit account can be opened, only if savings, current or minor account already exists. You can familiarize yourself with the list of required documents for account opening, as well as account opening and closing procedures on respective accounts pages.

Third parties can open Cumulative Term Deposit for minors only. In order to serve Cumulative Term Deposit, Minor account should be opened as well.

- Monthly, quarterly payment or payment at the end of period of accrued interest to the account specified by you.

- Monthly or quarterly compounding of accrued interest to the term deposit and payment at the end of deposit.

Interest paid for cumulative deposits is subject to income tax in accordance with RA legislation.

The interest can be paid either in deposit currency, or in AMD.

Important note

1. Cumulative deposit account is opened free of charge and is not subject to any service charges for the whole duration of the deposit term.

2. The current nominal interest rate of the cumulative Term deposit can be changed by the Bank (which will result in change of the annual percentage yield) based on the change of the Bank’s retail base rate. In case of change of interest rate you will be notified at least 1 month prior to the change entering into force. In case of interest rate reduction you can terminate the deposit before the date of change entering into force and will receive the deposit amount and accrued interest in full. If the deposit is terminated after the changed interest rate enters into force interest calculation applicable for premature withdrawal of the deposit will be applied.

3. Cumulative Term Deposit Agreement is not subject to automatic renewal. Upon maturity the deposit principal and interest amount are subject to repayment as per instruction provided by customer in the Cumulative Term Deposit Agreement.

4. Deposits placed by individuals are subject to repayment at the first request of the depositor.

| Currency |

Bank Retail Base Rate (RBR, %) |

Deposit Term |

Deposit Term |

Deposit Term |

Deposit Term |

|---|---|---|---|---|---|

| 36 Months |

48 Months |

60 Months |

120 Months |

||

| AMD |

9.00 |

RBR - 1.50% 7.50% |

RBR - 1.50% 7.50% |

RBR - 1.00% 8.00% |

RBR - 1.00% 8.00% |

| USD |

3.20 | RBR - 0.70% 2.50% | RBR - 0.45% 2.75% | RBR - 0.20% 3.00% | |

| EUR |

6.90 | RBR - 5.40% 1.50% |

RBR - 5.15% 1.75% |

RBR - 4.90% 2.00% |

| Currency |

|

|---|---|

| Bank Retail Base Rate (RBR, %) |

|

| Deposit Term |

120 Months |

| Currency |

AMD |

| Bank Retail Base Rate (RBR, %) |

9.00 |

| Deposit Term |

RBR - 1.00% 8.00% |

| Currency |

USD |

| Bank Retail Base Rate (RBR, %) |

3.20 |

| Deposit Term |

|

| Currency |

EUR |

| Bank Retail Base Rate (RBR, %) |

6.90 |

| Deposit Term |

The interest rates on deposits exceeding AMD 250 million or, in case of for foreign currency 500 thousand units of the relevant currency, are set on contractual basis in accordance with the General Terms and Conditions.

THE ABOVE RATES ARE NOMINAL AND INTEREST INCOME RECEIVED FROM TERM DEPOSITS ARE SUBJECT TO TAXATION IN ACCORDANCE WITH RA LEGISLATION.

2Cumulative term deposit interest rates in AMD are effective from 29/05/2018

Cumulative term deposit interest rates in EUR are effective from 01/11/2023

Cumulative term deposit interest rates in USD are effective from 01/11/2023

Term deposit interest calculation is done on daily basis on total deposit balance for the entire deposit term. Daily interest rate is equal to 1/365 of applicable interest rate for the deposit type and term (for leap year 1/366 ratio is applied).

| Currency |

Periodicity of interest payment |

Deposit Term |

Deposit Term |

Deposit Term |

Deposit Term |

|---|---|---|---|---|---|

| 36 Months |

48 Months |

60 Months |

120 Months |

||

| AMD |

Monthly Quarterly |

7.76% 7.71% |

7.76% 7.71% |

8.30% 8.24% |

8.30% 8.24% |

| USD |

Monthly Quarterly |

2.53% 2.52% |

2.78% 2.78% |

3.04% 3.03% |

|

| EUR |

Monthly Quarterly |

1.51% 1.51% |

1.76% 1.76% |

2.02% 2.01% |

| Currency |

|

|---|---|

| Periodicity of interest payment |

|

| Deposit Term |

120 Months |

| Currency |

AMD |

| Periodicity of interest payment |

Monthly Quarterly |

| Deposit Term |

8.30% 8.24% |

| Currency |

USD |

| Periodicity of interest payment |

Monthly Quarterly |

| Deposit Term |

|

| Currency |

EUR |

| Periodicity of interest payment |

Monthly Quarterly |

| Deposit Term |

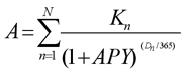

The annual percentage yield is being calculated based on the formula below:

where:

A – is the initial deposit amount.

n – is the consecutive number of the Term deposit related monetary flows.

N – is the last number of the Term deposit related monetary flows (including the monetary flow at the moment the Term deposit started), after which the Term deposit agreement term is being considered as expired.

Kn – the flows of the Term deposit invested at the moment of Term deposit opening and/or during the operation of it, as well as the flows of the capitalized interests, and, if available, of the mandatory fees.

Dn – is the number that indicates how many days are passed from the moment the Term deposit has been opened till the Term deposit related monetary flows are being done, including the consecutive n-th one. In case the monetary flows are at the moment of Term deposit opening, D1 = 0.

Ways to save

After you open the long term cumulative Term deposit, funds may continue to be deposited into the account at any time either by yourself or any third parties.

To replenish cumulative Term deposit you can:

- During deposit accumulation period the customer can top up3 the deposit amount with overall AMD 5 million (for deposits in US dollars and euros, respectively USD 10,000 or EUR 10,000) or 50% of initial deposit amount, whichever is higher, during the first ⅓ of the accumulation term.

- Customer can top up3 the deposit amount during the first ½ of deposit accumulation period via periodic written standing instructions (monthly or quarterly) provided during deposit opening, on monthly perspective being no more than AMD 250,000 (for deposits in US dollars and euros, respectively USD 500 or EUR 500) or 2.5% of the initial deposit amount, whichever is higher.

Initial deposit amount is the sum of the funds actually deposited on the deposit account during the first month after the deposit opening, which should be defined by the deposit agreement.

Third parties can credit funds to cumulative deposit account on the name of the deposit holder in scope of Cumulative Term Deposit agreement terms.

3 The replenishment of the Cumulative Term Deposit account is done immediately after the respective instruction is received.

You can transfer funds to the cumulative deposit via the following channels:

- ATM network: our ATM network comprises more than 50 ATMs at over 40 locations in Yerevan where you can effect your transfers

- Phone Banking: call us at +374 (60) 655 000 7 days a week, 24 hours a day and ask our Contact Centre agents (if registered for Phone Banking service)

- Internet/Mobile Banking: make your transfers 24/7 via HSBC Personal Internet Banking and Mobile banking services from anywhere in the world and any time during the day, at no additional cost (if registered for Internet/Mobile banking services)

- Branch network: you may visit any of our branches/offices to make your payment transactions in cash or via transfer

Learn how much you have already saved

You will receive monthly statements reflecting, among other information, your initial deposit amount, savings paid in to your deposit, total balance and interest paid.

The statements can be delivered to your postal address, sent via email or collected from any branch of the bank. You can familiarise yourself with conditions, terms and fees of provision of statements, copies of statements or other information by referring to Tariff of Charges and Terms and conditions.

Example

| Accumulated amount |

Accumulated amount |

Accumulated amount |

||

|---|---|---|---|---|

| Initial deposit |

Monthly savings |

After 5 years |

After 7 years |

After 10 years |

| AMD 100,000 |

AMD 30,000 |

AMD 2,258,303 |

AMD 2,606,955 |

AMD 3,233,885 |

|

Monthly savings |

|

| Accumulated amount |

After 10 years |

|

AMD 30,000 |

|

| Accumulated amount |

AMD 3,233,885 |

The interest rate for the cumulative Term deposit is equal to the difference of the Bank's retail base rate and the Bank's fixed margin.

Things you should know

Financial directory (website in Armenian)

Your Financial Directory is an electronic search and comparison tool for services offered to individuals to ease the process of making the most effective choice for you.

Important notice

A customer's right to manage their bank account and the funds available on it can be restricted due to decisions issued by the Judicial Acts Compulsory Enforcement Service or tax authorities based on court verdict. The customer may be informed about this after the bank has executed the decision on hold.

Levy of monetary funds without order of the customer can be executed on decisions issued by Judicial Acts Compulsory Enforcement Service and tax authorities based on court verdict. The customer may be informed about this after the bank has executed the decision on levy of funds from the customer’s account.

Last updated on: 22.04.24, 06:16