Online security device

Overview

- We're serious about Online Banking security: At HSBC, Online Banking security is taken very seriously. That's why in 2013 HSBC Bank Armenia upgraded our Online Banking service and all Online Banking customers were provided with a new security device which helps safeguard all their transactions when banking online.

- Fraud protection: Your Security device introduces the latest advances in Online Banking technology to protect you against online threats.

- Advanced security technology: Proven to be even safer than other security code technologies (such as SMS security code technology).

- Continuous validation: Constantly validating that it is you making the transaction.

Features

New Security device

There are several new functions in the upgraded HSBC security device. These functions have been introduced to face the risk of online threats. At HSBC, being proactive and constantly upgrading and evolving security methods to combat these threats is very important.

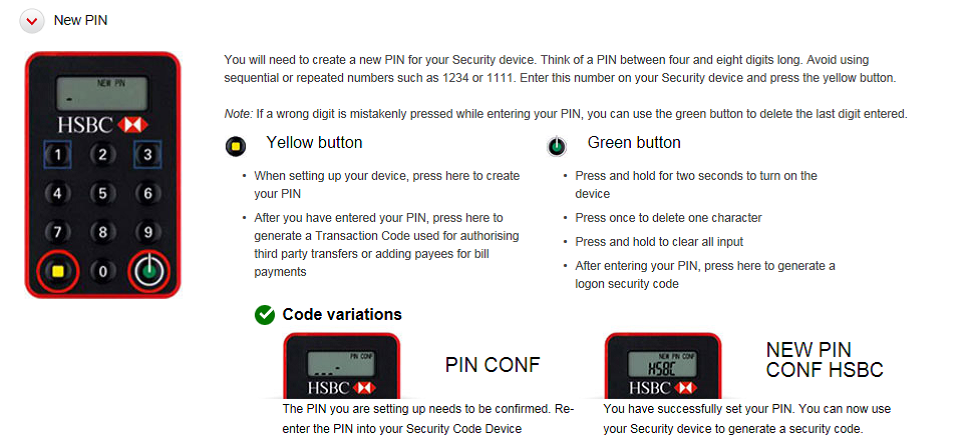

What's New?

- A new stylish look

The new device has a completely different look and is much slimmer. It easily slides into your pocket or wallet. - PIN protected

A PIN code is required for use of the device, offering you great peace of mind by preventing third party misuse. - Protect your transfers and bill payments

When making a third party transfer or adding payee for bills, you will need to generate a Transaction Signing Code, which ensures that it's really you making that transfer or payment.

How we protect you

How HSBC protects you when banking online

At HSBC, a variety of measures are used to protect your financial information and ensure it is kept safe and secure.

- Multi-layer logon verification

Your financial information is protected by a sophisticated combination of a unique username, a memorable answer and a one-time security code generated by your security device. - Transaction verification

When you transfer money or pay bills online, HSBC prompts you for a transaction code generated by your security device. This ensures that only you can authorise payment and transfer requests. - 128-bit encryption

HSBC uses 128-bit SSL encryption, which is accepted as the industry standard level. - Automatic 'time-out' feature

As a security measure, your Online Banking session will automatically shut down or time-out after a period of not being used. You should always log out and close your Online Banking session when you have finished.

You also have a role to play in security

It is recommended that you take the following actions to ensure online banking security:

- Download updates regularly to ensure your computer is protected with the latest antivirus and firewall protection software at all times

- Choose a security answer that is easy for you to remember, but not easy for someone else to guess. Security answers that combine alphabetical and numerical characters are generally harder to guess (e.g. a7g3cy91)

- Do not choose a security answer that you use for other services such as emails. It should be unique.

- Change your security answer on a regular basis

- Never reveal your online banking security answer to anyone. HSBC staff will never ask for your security answer

- Do not write your Online Banking username together with your security answer. Do not write your security answer in a recognizable format and never leave your logon details with your security device

- Disable the functions on your computer or browsers that remember logon details.

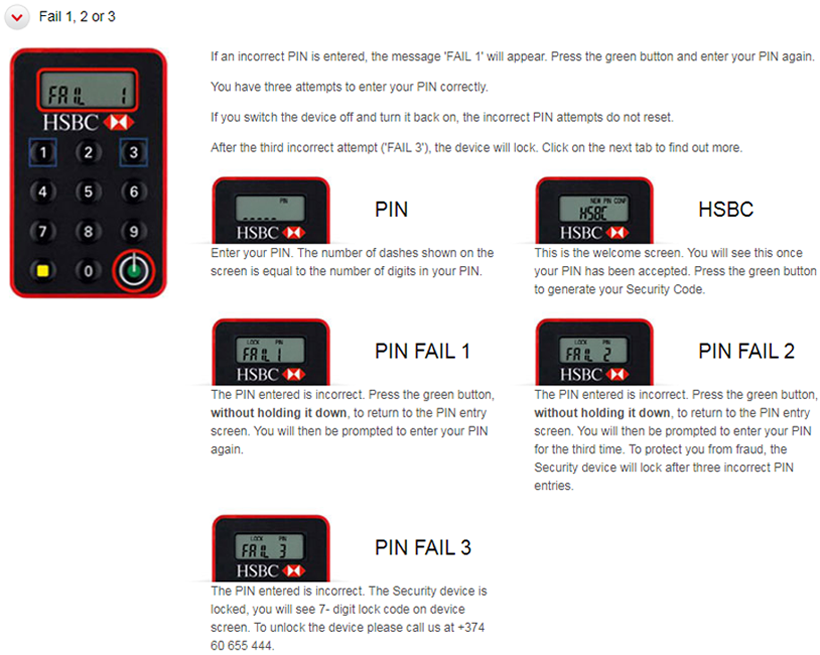

If you suspect someone has access to your online banking details, call us immediately on +374 (60) 655 444.